Kid's Corner

It's Never Too Early to Learn the Value of Money

Skip to Content Skip to Site Navigation

It's Never Too Early to Learn the Value of Money

Activities and ideas for our younger savers as well as our new section, Young Entrepreneurs. Explore business ideas started by and run by kids like you!

Financially literate people know how to achieve long-term goals and make healthy financial decisions.

On the other hand, those who are not financially literate have difficulty applying financial decision-making skills to real-life situations. Not only do they tend to make unhealthy money decisions that create financial problems, they have trouble reaching financial milestones. In America today, financial illiteracy has become an epidemic. A study done by the Financial Industry Regulatory Authority Foundation estimated that nearly two-thirds of Americans can't pass a basic financial literacy test. That's a problem.

Whereas basic literacy is a priority for public educators, financial literacy is not.

Here is something you can be doing right now to raise financially literate children.

Children need to understand the correlation between work and earnings from a young age. If your kids are actually doing the work, don't be apprehensive about paying them. Rewards motivate children, and money is an attractive reward. Allowing them to take on chores that they can get paid for not only teaches them the value of hard work but helps them learn how to manage their money and provides them with a feeling of accomplishment. If they don't do their work, don't pay them.

You can also cultivate their entrepreneurial spirit by encouraging them to offer babysitting, pet care, yard work or housecleaning services to friends, neighbors or relatives. Kids who work for pay can learn the cost in labor of an impulse purchase without monumental consequences. They can also learn the satisfaction of working hard to build savings and achieve goals.

Children who understand the value of hard work learn to be responsible for what they produce.

Children, and adults, often wonder what career paths are available at a bank. See our Careers in Banking brochure for more information.

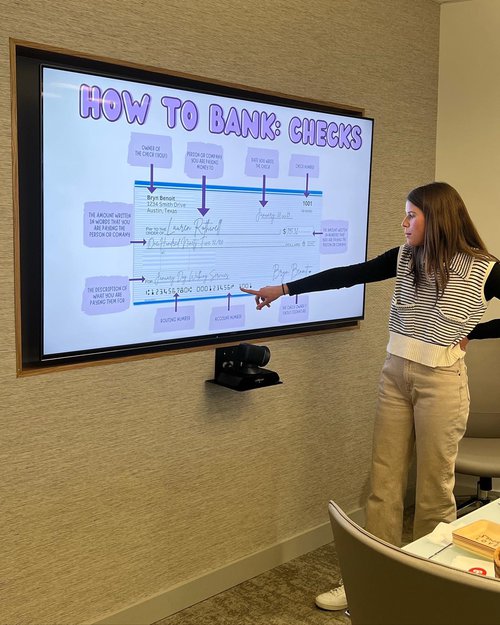

Benchmark Bank Austin invited the children of customers to attend a fun and informative evening of learning about banking basics. In keeping with the theme of Learning S'more About Banking, a power point lesson was taught and s'mores were served. Yum!

Third Party Site Disclosure

Links that may be accessed via this site are for the convenience of informational purposes only. Any products and services accessed through this link are not provided or guaranteed by Benchmark Bank and are not FDIC insured. The site you are about to visit may have a privacy policy that is different than Benchmark Bank’s.

Please review their privacy policy. Benchmark Bank does not endorse the content contained in these sites, nor the organizations publishing those sites, and hereby disclaims any responsibility for such content.